Barrick Gold Still Wants NovaGold

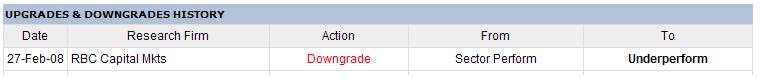

This downgrade caught my eye this morning

here:

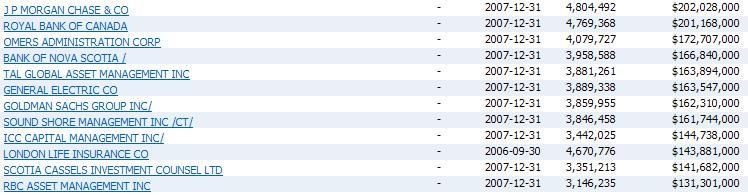

But then, I remembered seeing that name on a list of institutional holders of Barrick Gold:

[A more complete list of Institutional Holders of Barrick Gold can be found

here.]

Hmmmm. RBC, which stands for Royal Bank of Canada, shows up twice on Barrick's list above: Once as Royal Bank of Canada, and the other as RBC Asset Management Inc. They are not in the TOP 10 holders, but they still have significant interests. More than me, that's for sure. Anyway, RBC Capital Markets is also a part of the Royal Bank of Canada.

The only reason this makes me go "hmmmm" is that this technique was used in a local takeover in Kansas City not too long ago. Two firms that were major institutional holders of IHOP had rated Applebee's as underperform in two separate months early in the game. Almost like a setup, that resulted in a lower share price of Applebee's prior to the merger. That merger was lead by the former head of the SEC, Richard C. Breeden from Greenwich, Connecticut, who had earlier bought 5% of Applebee's and threatened its board of directors. He got $500,000 to back off. You'll find that story is here.

Isn't there some sort of law against this practice? Or is it simply another "street" tactic?

Hate to be so blunt, but to me, that comes under the heading of lyin' and stealin'.

Guess there's not much one can do except point it out, because:

© 2008 by Edward Ulysses Cate

Help Support This Site

Commentary Index

Home