Gold Is Our Enemy

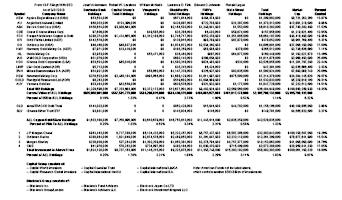

The previous commentary, "Gold Is My Enemy", contained graphs of how the price of gold had out-performed some extremely large holdings of Other People's Money [OPM]. This commentary links to the PDF that shows what the six largest investment funds have invested in precious metals [PM] stocks versus the rest of their dollar-based holdings.

The components of the HUI index were chosen because this index is widely tracked and influences PM buy/sell decisions. Therefore, manipulating the value of companies in this index would help keep the price of gold under control, while profiteering from the manipulation against their own clients.

It also shows how little these large investment funds have in PM stocks compared to their other investments, and thus "could" take the opportunity to manipulate the index to prop up the value of their other holdings.

These investment funds also control large chunks of these PM companies, effectively controlling the firms themselves and their financing. Please note that the percentage of control is only the minimum, due to the fact that these funds own parts of other companies that have investments in these same PM companies. You can be assured that THEY know exactly how much THEY control.

This is why some PM company's management appear to manage their firms against their own self-interest. But in the larger context of these funds, it makes perfect sense. That would explain that as the price of gold climbs that the stock value of many of these PM companies decline.

An example has just been announced.

(Kinross is a component of HUI):

Kinross Gold to Buy Red Back Mining for $7.1 Billion

Aug. 2 (Bloomberg) -- Kinross Gold Corp., Canada’s third- largest producer of the metal, said it agreed to buy the shares of Red Back Mining Inc. it doesn’t already own for about $7.1 billion to add mines in West Africa.Now let's take a look at a five-year chart:

It becomes quite obvious that for years Kinross's share price tracked along with the price of gold. However, when Kinross started thinking about merging, the price of Kinross's shares declined, while gold continued to increase. Red Back Mining shares also continued steadily increasing.

But why would anyone want to keep the Kinross stock subdued for a while?

Maybe this text from the above story answers the question:

Red Back investors will get 1.778 Kinross common shares and 0.11 of a Kinross common share purchase warrant for each Red Back common share held, the companies said today in a statement.Keeping the share price subdued substantially reduces the cost of the takeover, and effectively re-channels large profits away from Red Back's current investors. Perhaps they'll allow Kinross to rise now, but then that would allow excitement in the gold price.

You know that as the number of dollars it takes to convince an owner of one ounce of gold to give up that one ounce goes higher, then the value of those dollars is declining. The only argument then is by how much.

If you're one of those six men [listed in the PDF] that control trillions of dollars of OPM, then the value of gold directly affects your ability to keep other folk's hard-earned wealth under your control. You certainly don't want them cashing out and taking ownership of ounces of gold.

Gee, how else could they profit by lyin' and stealin'? Of course, they call it "managing" your wealth and "earning" their fees. If it was that simple, the billions of dollars in profits would be spread among their clients, and the fund managers would certainly earn a decent living by performing this service. But not billions.

So why would these men say, or even think, that "Gold is our enemy?"

First of all, if a customer takes out $1200 to take possession of one ounce of gold, $120,000 has just been removed from the fractional reserve banking system, if not more due to leveraging. Ouch! That means less fees and trading profits from OPM.

Due to the fractional gold trading system, it also means the removal of 44 to 100 pieces of paper gold ounces. Again, less fees and trading profits from OPM.

And finally, no longer having control of OPM, they can no longer use that wealth against the very people who labored and saved it.

So I'm going to leave it to you to generate your own opinions about what the PDF data shows. I know what it means to me, and supports what I wrote above. But there is soooo much more here.

For example, owning all of the companies in the index would only take 6.22% of their total holdings, which is much less than what they hold as a group in JPMorganChase (JPM), Goldman-Sachs (GS), Morgan Stanley (MS) and CME Group (CME). These four companies were listed here because of their roles in the manipulation of gold, silver and its trading.

Of course, there is no manipulation of our free markets.

I do know that those addicted to OPM (Other

People's Money) are just like those addicted to opium.

Whatever they can get will never be enough!

That's just another reason that

Sometimes

The Dragon Wins

© 2010 by Edward Ulysses Cate

Help Support This Site

Commentary Index

Home