From Exter's Pyramid To World of Finance

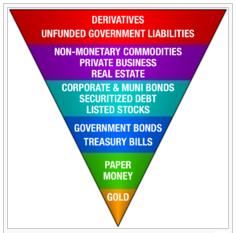

To understand why there's so much manipulation taking place in the "world of finance," it would help to know just what IS the "world of finance." At one time, Barclays even had a corporate slogan: "Quietly conquering the world of finance." So, I guess they know. One illustration that some folks use to explain this financial world is Exter's Pyramid. However, I'd like to show you that it's only a small piece of the "world of finance."

John Exter was a central banker, a member of the Pilgrim Society among other things. Personally, I don't trust any organization that would have Henry Kissinger as a member. But that's besides the point, and anyway, to them I'm irrelevant. The following quote is from Wikipedia, which has more information on John Exter (here.)

It should be obvious that Exter's inverted pyramid is not free-standing in nature.

No pyramid stands on it's point. Even if Exter tries to make a point.

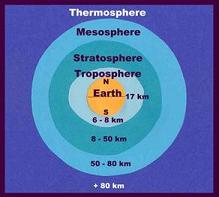

One side of Exter's pyramid is simply a triangle, like a slice removed from a pizza. Rotate the inverted pyramid in your mind so that a complete circle is formed. This is now a similar view as if you had sliced our earth and its atmosphere in half.Below, notice that there are five levels of atmosphere just as there are five levels of finance in Exter's pyramid shown above.

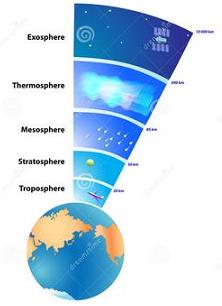

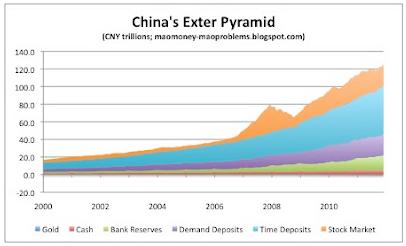

If you were to look at a side-view of these levels of finance from certain areas of the world,

those different levels could look like these below.

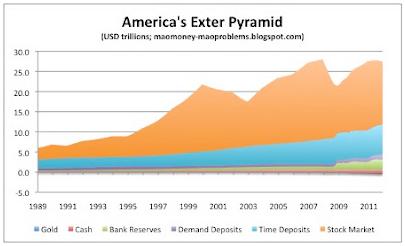

The above information was featured in a Zero Hedge commentary here.

Please note that this commentary didn't even try to represent trillions in derivatives.

However, that is not the "world of finance" either. Our world is not flat, and neither is the "world of finance." So take one more step. In your mind, rotate the "pizza" into a sphere. Now you can visualize the "world of finance" with gold (and silver) at its core or center, and the different levels of risk completely circling that core. The further away from the core, each level of finance is much larger than the previous level and also entails higher risk.

Think of the "world of finance" as somewhat similar to the physical world in which we live, with earth as its core, and everything else above the ground as its atmosphere. The difference is that our atmosphere was made by nature, and all levels above the golden core are man-made promises that are currently expanding every day. The higher you go in our atmosphere, the higher your risk of surviving if you should fall. Same with the "world of finance."

Promises are as flighty and weighless as gases. No matter how you travel through the layers of finance, promises are most often only exchanged for other promises. Only when promises are exchanged for gold (or silver) are you on "solid" ground. NOTE: Yes, I know there are other precious metals, but let's keep this simple.

With Exter's inverted pyramid rotated, you can see that the "world of finance" becomes a sphere with a golden core, with distinct levels above it just like our earth and its levels of atmosphere. That gives new meaning to these phrases; "high-flying securities," "blue-sky ventures," and "launching new securities." I'm sure you can name some examples yourself.

Everything above the gold (and silver) core are nothing more than promises. The only solid point is the metallic core, which has no counterparty. Everything else are promises created from almost nothing, and those promises can disappear into the void almost effortlessly. Don't forget, it was John Exter, a central banker, that pointed this out in the first place by bringing forth Exter's Pyramid.

Which is exactly why those who profit from manipulating promises hate gold. To profit from your exertions, they must convince you to trade your physical labor and objects for paper promises, and the further away from gold the better. Therefore, extreme manipulation of all financial markets, especially gold and silver, is the only way certain entities can continue to pilfer wealth from citizens of the world without direct physical confrontation. Unfortunately, when these financial sociopaths get really desperate, violence also takes place.

Owning physical gold and silver for long-term investment is simply self-protection,

because if you're only holding onto promises,

Sometimes

The Dragon Wins

© 2014 by Edward Ulysses Cate

Help Support This Site

Commentary Index

Home

Comments powered by Disqus